income tax rates 2022 vs 2021

Resident tax rates 202223. The state will adopt a 25 flat-rate income tax system starting with the 2023 tax year one year earlier than.

Changes To Uk Tax In 2022 Holborn Assets

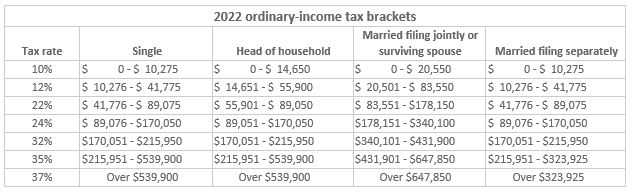

However your bracket does not equal your tax rate.

. The current tax year is from 6 April 2022 to 5 April 2023. Taxable income Tax rate. 2021 federal income tax brackets for taxes due in April 2022 or in.

Thats a 250 increase vs. There are seven federal income tax rates in 2022. The 2022 tax rates themselves are the same as the rates in effect for the 2021 tax year.

The 2022 and 2021 tax bracket ranges also differ depending on your filing status. Note that the updated tax rates and taxable income brackets would only apply for the 2021 tax year. As noted above the top tax bracket remains at 37.

This guide is also available in Welsh Cymraeg. A tax cut for Arizonans is coming sooner than expected. The US tax system is progressive meaning that the more you earn the more you pay.

Which bracket you are in depends on your taxable income. Tax brackets and rates for the 2022 tax year as well as for 2020 and previous years are elsewhere on this page. 0 percent for income up to 41675.

For the years 2020-2022 there are seven different brackets for each year. A massive 19 billion Arizona income tax that mainly benefits the wealthy championed by Ducey and enacted by Republicans who control the state Legislature in 2021. Thats up from 4800 in 2021.

For the 2022 tax year that same bracket covers 47299 of taxable income 89075 41776 47299. For TurboTax Live Full Service your tax expert will amend your 2021 tax return for you through 11302022. The difference is due to inflation during the 12-month.

In 2022 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1. In Act 228 of 2022 South Carolina enacted changes to the states marginal income tax rates and brackets beginning with tax year 2022. For the 2022 tax year the IRS bumped up the income thresholds for all filing statuses to account for inflation.

Final 2021 Tax Brackets. You can compare the changes between 2021 and. Below are the official 2021 IRS tax brackets.

Any taxable income exceeding 25 million is subject to the top marginal rate of 109 percent. Tax brackets and tax rates. There are seven federal tax brackets for tax year 2022 the same as for 2021.

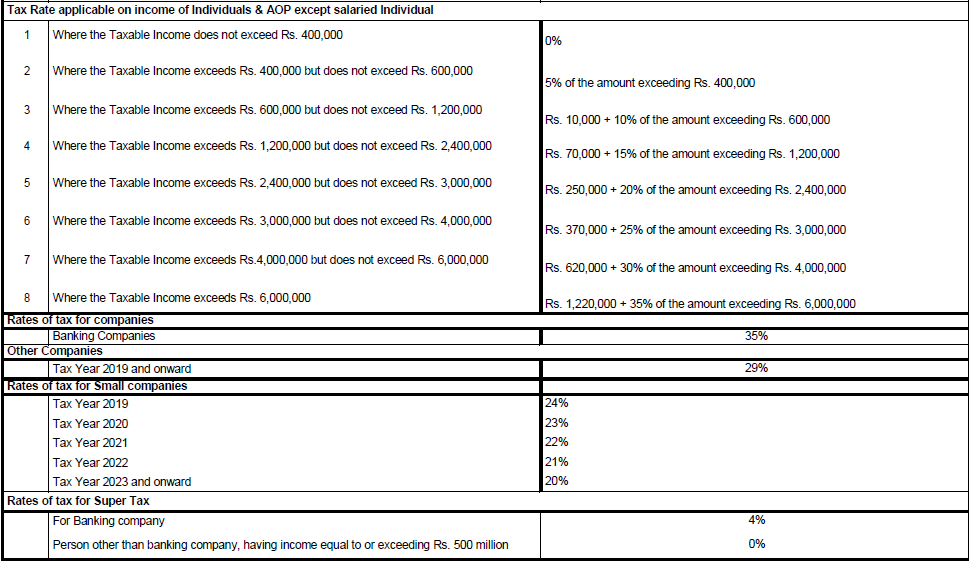

What Are the Slabs for the Year 2021 to 2022. 19 cents for each 1 over 18200. The capital gains tax rates will remain the same in 2022 but the brackets will change.

The most the deductible can be is 7400. The other six tax brackets set by the IRS. Which bracket you are in.

However as they are every year the. 15 percent for income between 41675 and. 10 12 22 24 32 35 and 37.

Those earning between 13900 and 215400 are subject to marginal tax. For example for single filers the 22 tax bracket for the 2022 tax year starts at 41776 and. Tax on this income.

After 11302022 TurboTax Live Full Service customers will be able to amend their. Although the tax rates didnt change the income tax brackets for 2022 are slightly wider than for 2021. Income Tax Slab for Individual Taxpayers HUFs Less than 60 Years Old Income up to 250000-No tax is payable.

For tax year 2022 for family coverage the annual deductible must be at least 4950. The tax rates were collapsed. So for 2022 the 22 bracket for single filers is 1450 wider.

For the years 2020-2022 there are seven different brackets for each year.

Malaysia Personal Income Tax Rates 2022

Don T Forget To Factor 2022 Cost Of Living Adjustments Into Your Year End Tax Planning Boulaygroup Com

Individual Income Taxes Urban Institute

Taxtips Ca Canada S 2021 2022 Federal Personal Income Tax Rates

Tax Season 2021 New Income Tax Rates Brackets And The Most Important Irs Forms

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

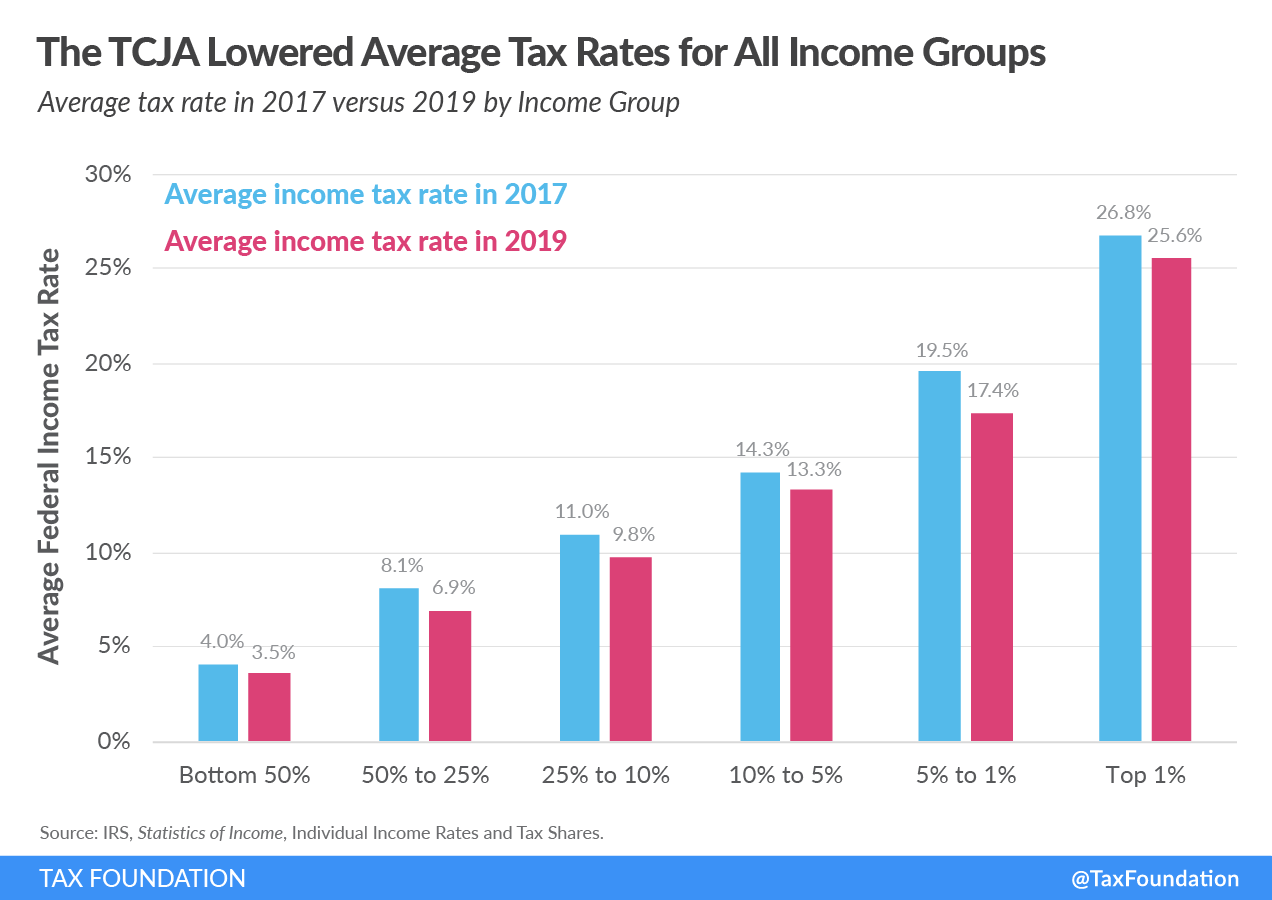

Summary Of The Latest Federal Income Tax Data Tax Foundation

China Annual One Off Bonus What Is The Income Tax Policy Change

Tax Rates 2021 Archives Filer Pk

Awp Income Tax Changes Under The September 13th House Ways And Means Proposed Awp

Policy Basics Marginal And Average Tax Rates Center On Budget And Policy Priorities

Income Tax Rate On Private Limited Company Fy 2021 22 Ay 2022 23

Income Tax Rates Companies Partnership Firm Llp Fy 2021 2022

Income Tax Slabs Ay 2021 2022 Sensys Blog

Summary Of The Latest Federal Income Tax Data Tax Foundation

New Income Tax Slab Regime For Fy 2021 22 Ay 2022 23

:max_bytes(150000):strip_icc()/2021StateIncomeTaxRates-2fb0a8148ecb444c8d1399d839a69ffb.jpeg)

State Income Tax Vs Federal Income Tax What S The Difference

State Corporate Income Tax Rates And Brackets Tax Foundation